The story of the Vanderbilt family in the United States from their meteoric rise, unparalleled affluence, and subsequent decline – serves as one of history’s most famous cautionary tales. By exploring the origins, successes, and mistakes of the Vanderbilts, this article illustrates the urgent need for responsible financial management and succession planning.

The Vanderbilt Empire: How Wealth Was Built

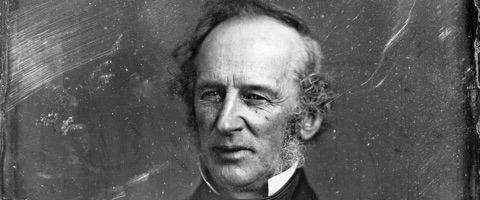

Cornelius “Commodore” Vanderbilt began the family’s story in humble circumstances, borrowing $100 from his mother to start a ferry business between Manhattan and Staten Island in the early 1800s. Through extraordinary drive, shrewd entrepreneurship, and relentless expansion, he transitioned from ferries to steamboats, eventually moving into railroads and building what would become the New York Central Railroad. Vanderbilt’s railroad empire fueled American expansion, and his success culminated in the construction of New York’s Grand Central Depot and the founding of Vanderbilt University—a landmark $1 million donation, the largest of its time.

When Cornelius died in 1877, he left behind a fortune exceeding $100 million—more than the U.S. Treasury held at the time—making him one of the richest men in world history. His son, William Henry Vanderbilt, inherited the empire and doubled the fortune within a decade before his own death. Their combined wealth, adjusted for inflation, would be worth tens of billions today.

The Expansion and Early Philanthropy

Following these founding generations, the Vanderbilts grew in number and influence. Their name became synonymous with American royalty and luxury, embodied through extravagant homes like The Breakers in Newport or the sprawling Biltmore estate, as well as their generous philanthropy. Family members donated vast sums to universities, hospitals, and housing, attempting to balance their social status with charitable endeavours.

However, even in these early expansions, warning signs appeared. The Vanderbilts split the estate among various heirs, diluting control and setting the stage for future divisions. While their philanthropic activities were notable, they also led to static family wealth rather than continued compounding. William Kissam Vanderbilt famously commented that inherited wealth “is a handicap to happiness. It has left me nothing to hope for, with nothing definite to seek or strive for,” highlighting a lack of purpose and stewardship among heirs.

What Went Wrong? Financial Missteps and Extravagance

It wasn’t misfortune alone that ended the Vanderbilt Empire but a myriad of very human financial errors—a cascade of poor long-term planning, unchecked spending, and lack of preparedness for change.

Lack of Diversification: Most Vanderbilt wealth was concentrated in railroad and shipping stocks, industries vulnerable to disruptive change. This lack of diversification made them susceptible to shifts in transportation and the economy, especially as railroads became less dominant with the rise of trucks, cars, and airplanes.

High Liquidity: Assets were largely held in publicly traded shares, which heirs could easily sell to fund personal whims. Unlike hard assets such as real estate, these stocks provided little barrier against impulsive, short-term decisions.

Over-Spending: Successive generations indulged in extravagant parties, mansions, artwork, fashion, and luxury hobbies including horse racing and yachting. Social pressures and a desire to maintain celebrity status spurred spending excesses unmatched even by today’s standards. Events commonly cost hundreds of thousands, equivalent to millions today.

Estate Fragmentation: As the family grew, vast fortunes were divided among many heirs, each with little motivation or knowledge about maintaining businesses or investments. Without unified vision or control, the family drifted toward individual pursuits and rivalry rather than stewardship.

Changing Economy and Poor Planning: The Vanderbilt fortune was not structured to survive industrial shifts, economic downturns, or new tax laws. The Great Depression, the rise of estate and income taxes, and the decline of the railroad industry severely weakened their holdings. Much of the fortune was never transitioned into durable assets like city real estate, which could have preserved wealth.

Lack of Financial Stewardship Training: The founding Commodore never taught his heirs the skills needed to manage large fortunes. He gave little consideration to preparing the next generation for the responsibilities and disciplines of financial stewardship.

Failure to Preserve Capital: By the fourth generation most surviving Vanderbilts were socialites and “playboys,” noted more for their high society adventures than business acumen. Their spending outpaced investment returns, and by the late 20th century, none were ranked among America’s millionaires.

The Fall: Rags to Riches to Rags

By the mid-20th century, the Vanderbilt mansions were sold or demolished, family businesses went bankrupt, and most descendants lived comfortable but unremarkable lives outside the circles of finance and power their forebears had dominated. Journalist Anderson Cooper—one of the few contemporary Vanderbilts—famously confirmed there was no inheritance left for him.

No longer wealthy, they became a textbook example of the phrase “rags to riches to rags in three generations,” cited frequently by estate planners and financial advisers. Estate fragmentation, market changes, taxes, and absence of financial education ensured that what was once the world’s greatest fortune evaporated within a few generations.

Financial Planning: Lessons for Today

The Vanderbilt story provides crucial lessons:

Diversify assets and avoid overexposure to any one sector or asset class (such as cash).

Invest for the long term in asset classes that are resilient to technological and economic change.

Preserve capital with thoughtful estate planning that prevents fragmentation and sets conditions for use.

Educate heirs about the responsibilities and skills needed for wealth management.

Establish structures such as trusts and governance committees for oversight.

Plan for succession with clear guidelines, mentorship, and professional advice.

Instead of seeing great wealth as a permanent advantage, the Vanderbilts reveal that without sound planning, oversight, and discipline, even the mightiest fortunes can crumble. Their legacy, more than the grandeur of their mansions, remains as a powerful reminder: wealth unprotected is wealth soon lost. Financial planning is not just wise; it is essential for every generation that hopes to make its mark.

The content in this article was correct on 13/10/2025.

The value of your investment can go down as well as up and you may get back less than the amount invested

You should not rely on this article to make important financial decisions. Teachers Financial Planning offers advice on savings, pensions, investments, mortgages, protection equity release and estate planning for teachers and non-teachers.

Please use the contact form below to arrange an informal chat with an advisor and see how we can help you.